The web Browser you are currently using is unsupported, and some features of this site may not work as intended. Please update to a modern browser such as Chrome, Firefox or Edge to experience all features Michigan.gov has to offer.

Student Loan Repayment Program

The Student Loan Repayment Program for school staff working in Michigan’s districts serves as an effort to increase the retention of teachers, including those in critical shortage areas, aligning with goal 7 of Michigan's Top 10 Strategic Education Plan. An eligible individual who is approved for payments under this program shall use the funds provided to defray or eliminate the costs of their student loans.

FY26 Student Loan Repayment Program

- The fiscal year (FY) 2026 State School Aid Act, passed by the Michigan legislature and signed by the Governor on October 7, reallocated funding for the Student Loan Repayment Program for Michigan educators, which had been previously authorized by Section 27k of the FY 2024 and FY 2025 budgets.

- As communicated in an October 3 press release and a December 18 memo, the Michigan Department of Education (MDE) is disappointed with this elimination, as well as with the elimination of funding for other promising initiatives to address the teacher shortage and uplift the teaching profession in our state.

- While MDE would have preferred that the Student Loan Repayment Program continue, we are encouraged by the Legislature’s reallocation of funds that had been dedicated to this program to a block grant to districts to increase educator compensation.

- Section 27l of the FY 2026 State School Act provides over $350 million to districts “to increase compensation for educators and offset normal costs associated with retiree health care benefits.”

- At their discretion, districts may elect to utilize funding received through this grant to offset employees’ student loan expenses.

FY25 Application Timeline for Individual Applicants

- Employing districts were sent official Grant Award Notifications (GANs) on August 21, 2025, and individual educators applying to the FY25 Student Loan Repayment Program were notified of their application’s approval or denial status via a separate message on August 22, 2025. This message was sent to the email that was submitted to MDE with their application.

- If your application was approved, you must use the link below to report that the payments you reported on your FY25 Student Loan Repayment Program application were correct, or whether any payments have changed after your application was submitted.

Application Information

-

FY25 Information and Resources for Individual Applicants

FY25 Application Instructions

- Student Loan Repayment Program Application Instructions (PDF)

- Student Loan Repayment Program Loan Documentation Guidance (PDF)

FY25 Application Requirements

- To submit a successful application, individuals were required to:

- provide full name, valid e-mail address, and Personnel Identification Code (PIC) number,

- correctly identify the name of their employing district (intermediate school district, traditional school district, or public school academy),

- accurately report the amount of current loan payments made under qualifying Public Service Loan Forgiveness (PSLF) loan types or payment plans as well as the amounts of payments made between 10/1/24 and the time of application,

- upload required documentation establishing both participation in PSLF and matching the payment information provided in the application, and

- certify they meet all eligibility criteria under statute (see below), and that all information provided is correct and accurate.

- Since individual applicants were required to provide their PIC, MDE strongly recommended the following for individuals preparing to submit their applications:

- Use of the MOECS public search tool here: Michigan Online Educator Certification System. Individuals can search using their name and credential number to see their PIC number.

- Contact the employing district’s HR or administrative staff to confirm correct PIC number or to request a PIC as described above.

- Individual applicants were strongly recommended to use the instructional documents linked above to ensure successful applications.

NOTE: All staff employed by a school or district must have a PIC, regardless of position, title, or certification/permit status.

Updates for FY25

- Individual district staff members interested in receiving payments for FY25 were required to submit a successful and accurate application for the Student Loan Repayment Program by May 19, 2025.

- Since eligibility requirements were updated in statute, participation in FY24 did not mean eligibility for FY25.

- Therefore, all individuals wishing to participate in the Student Loan Repayment Program were required to apply for FY25, regardless of participation in the previous year (FY24).

- Intermediate school districts (ISDs) and local education agencies (LEAs), both traditional public school districts and public school academies (PSAs) employing those applicants were required to verify employment information. If employment was not able to be verified by the individual’s employer, an individual’s application was disqualified.

- New or updated Frequently Asked Questions (FAQs) have been posted to this site at the link above regarding the application system and payments made under the Student Loan Repayment Program.

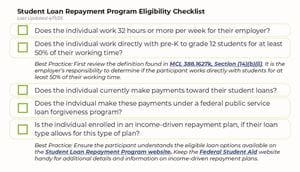

Updated Resource: 27k FY25 Eligibility Checklist

For FY25, this checklist helped both individual applicants and their employers determine participant eligibility. Applicants used this resource in addition to the information included below to guide them in understanding what information was required at the time of application.

-

Additional Information for Individual FY25 Applicants

IMPORTANT: Please do NOT send any participant loan documentation to the Michigan Department of Education via email. Sending participant loan documentation introduces a potential security risk, especially if there is personally identifiable information (PII) included.

As shown on the updated 27k Eligibility Checklist linked above, individuals were required to provide documentation demonstrating the following eligibility criteria:

- The individual must owe federal student loans.

- The individual must be currently participating in the Public Service Loan Forgiveness program, pursuant to federal law, and is in a payment plan that makes eligible payments toward federal public service loan forgiveness.

- The individual must be paying their loans under an income-driven repayment plan. The individual may be exempt from this requirement if their loan is not eligible for income-driven repayment, and must be prepared to submit documentation showing this exemption if required.

- The individual must currently work 32 hours or more per week for their employer.

- The individual must work in a role where direct contact with pre-K to 12 students comprises 50% or more of their working time.

For more information about PSLF, qualifying loans, and repayment plans, visit the Public Service Loan Forgiveness webpage.

Loans received under the William D. Ford Federal Direct Loan (Direct Loan) Program that qualify for PSLF. Payment plans that make eligible payments toward PSLF. - Direct Subsidized Loans

- Direct Unsubsidized Loans

- Direct PLUS Loans

- Direct Consolidation Loans

- Income-Contingent Repayment (ICR) Plan

- Income-Based Repayment (IBR) Plan

- Pay As You Earn (PAYE) Repayment Plan

- Saving on a Valuable Education (SAVE) Plan - formerly the REPAYE Plan

- 10 Standard Repayment Plan

- The maximum payment available to any eligible individual is $200.00 per month, or if the individual is employed in a district or intermediate district that is assigned to Band 6 in the Opportunity Index, up to $400.00 per month, for the duration of the program or the total amount of the eligible district staff member’s monthly federal student loan payment or whichever is less. (See our Frequently Asked Questions for more information on the Band 6 of the Opportunity Index.)

- Payments to eligible individuals must be made on a monthly basis in an amount specified by the department.

- Payments to an eligible individual must be made for no more than 10 years or until the eligible participant's federal student loan is paid off, whichever occurs earlier.

- Eligible individuals must only receive funding through the program if the eligible participant continues to meet the criteria of an eligible district staff member.

- Individual participants continue to be responsible for certifying to MDE:

- that they made payments toward their eligible federal student loan with the funding received through this program,

- if the individual leaves the program, on the date they left the program, that they made payments toward their eligible federal student loan with the funding received through this program, and

- any increases or decreases in their monthly payment toward the eligible federal student loan.

-

Additional FY25 Information for Districts

- For FY25, districts verified employment details as required by statute. The employment verification window ended on Tuesday, June 17, 2025.

- As required by statute for FY25, districts will:

- receive Grant Award Notification (GANs) from MDE,

- receive funds from MDE for the purpose of paying eligible participants along with regular State Aid payments,

- pass accurate payments to eligible participants,

- keep accurate records on payments made, and

- report to the MDE any “leftover” or “excess” funds during a reconciliation window to be announced.

- See our Frequently Asked Questions (FAQ) page for information on finding out whether a district is in the Band 6 of the Opportunity Index.

- The Program Administration webpage provides information and best practices for making payments to approved participants under the FY25 Student Loan Repayment Program.

Contact Information

For more information or support, please contact MDE-EdWorkforceGrants@Michigan.gov.