The web Browser you are currently using is unsupported, and some features of this site may not work as intended. Please update to a modern browser such as Chrome, Firefox or Edge to experience all features Michigan.gov has to offer.

7.05.08: Adjusting wages or hours on a DTL2 record

Steps for adjusting a record

- On a DTL2 record, enter the begin and end dates of the record you are adjusting (typically a prior pay period). If adjusting a previously posted record, use the View Employee Info screen to verify the begin and end dates used on the original record. The dates on the adjustment record must match the dates on the original record. If a positive adjustment record is reporting wages/hours not previously reported, a different class code may be used. If you are adjusting wages or hours for a pay period before Oct. 1, 2002, do not submit an adjustment record. Complete the Request for Adjusting Records Prior to October 1, 2002 (R3489C).

- Populate the Retirement Hours field if needed. Always use a positive number.

- Select the appropriate adjustment wage code from the drop-down box. For a negative adjustment the negative wage code must correspond to the wage code used to post the original wages. Use the View Employee Info link to verify the wage code used on the original wages and see the table in section 13.02.02: Detail 2 records - wage codes for the correct corresponding wage code.

- Populate the Employer Reported Wages field if needed. Always use a positive number.

- You may populate the Employee and Employer contribution fields if you wish. ORS will calculate the amount for both fields when the adjustment record runs through batch processing. The calculated amount can be seen on the Download Detail after batch processing, and the reported column will be blank if you do not fill them in.

- If you are making a positive adjustment record, enter a Pay Rate (required for positive adjustments.)

- Select the appropriate employment class code from the drop-down box. If adjusting a previously posted record the class code must be identical to the class code used to post the original wages. Use the View Employee Info link to verify the class code used on the original record. If a positive adjustment record is reporting wages/hours not previously reported, a different class code may be used. If the pay rate is or was $100.00 or more, you must populate the Contract Begin Date and Contract End Date fields.

- Populate the Frequency of Pay field if needed.

Examples of adjustments

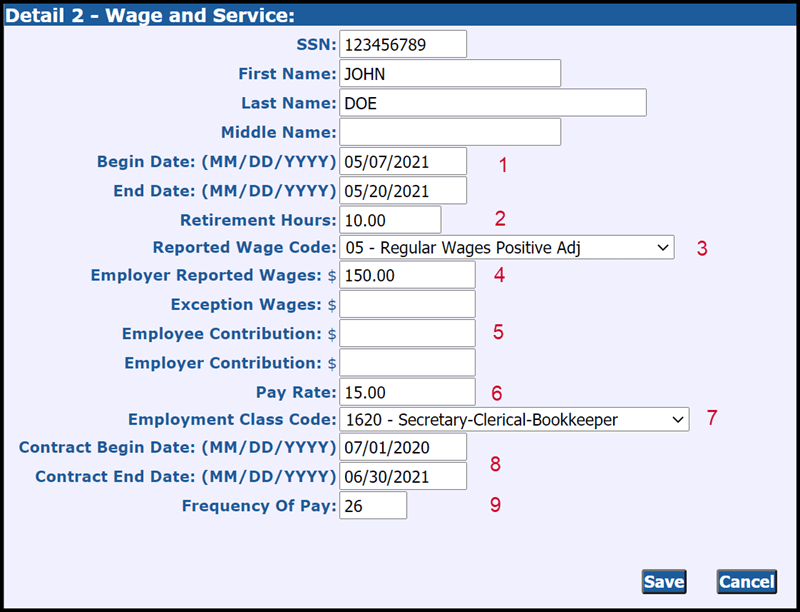

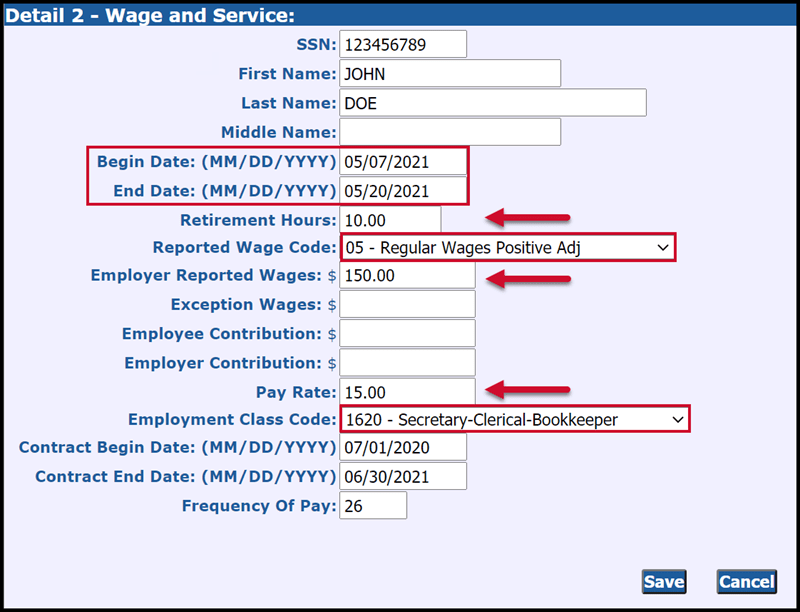

Positive adjustment to regular wages

You underreported an employee's wages in a pay period ending 05/20/2021 by $150. You are making this adjustment in the pay period ending 6/17/2021. The original record, for the pay period ending 5/20/2011, contained the following data:

|

Wage Code: |

01 |

|

Begin Date: |

05/07/2021 |

|

End Date: |

05/20/2021 |

|

Wages: |

$2,000 |

|

Hours: |

80.00 |

|

Class Code: |

1620 |

|

Pay Rate: |

26.88 |

In the 06/17/2021 report, you will report two DTL2 records: one for the current pay period regular wages (as you normally would) and a second for the adjustment, as follows:

|

DTL2 record - current pay period |

DTL2 record for adjustment |

||

|

Wage Code: |

01 |

Wage Code: |

05 (positive adjustment to regular wages) |

|

Begin Date: |

06/07/2021 |

Begin Date: |

05/07/2021 |

|

End Date: |

06/20/2021 |

End Date: |

05/20/2021 |

|

Wages: |

$2,500.00 |

Wages: |

$150.00 |

|

|

|

Hours: |

0.00 |

|

|

|

Class Code: |

1620 |

|

|

|

Pay Rate: |

26.88 |

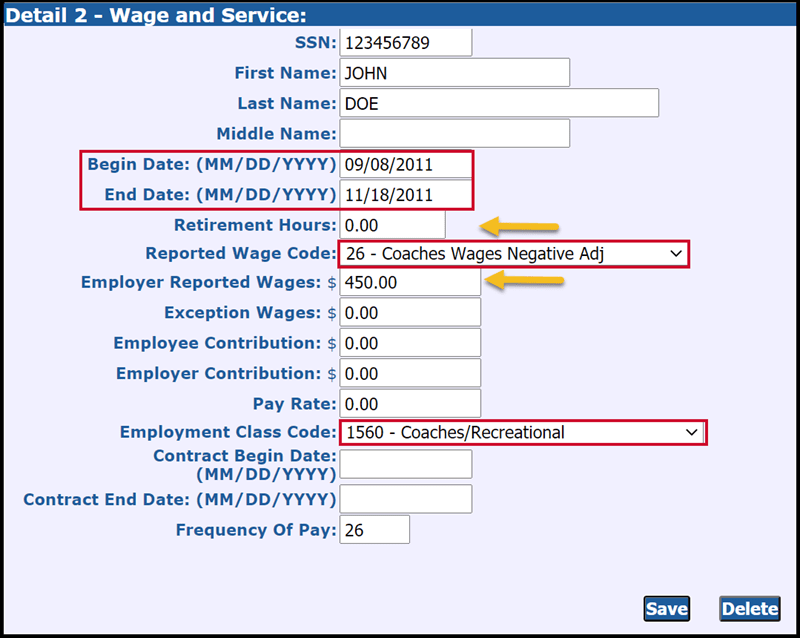

Negative adjustment to coaches wages

Your reporting unit overreported coaches' wages (wage code 11) for an employee in the pay period ending 11/18/2011. You are making this adjustment in the pay period ending 05/20/2021.

The original pay period record ending 11/18/2011 contained the following data:

|

Wage Code: |

11 |

|

Begin Date: |

09/08/2011 |

|

End Date: |

11/18/2011 |

|

Wages: |

$2,900.00 |

|

Hours: |

245.00 |

|

Class Code: |

1560 |

|

Pay Rate: |

10.00 |

In your current report (pay period end date 05/20/2021), you will enter a DTL2 record as follows:

|

Wage Code: |

26 (negative adjustment to Coaches Wages) |

|

Begin Date: |

09/08/2011 |

|

End Date: |

11/18/2011 |

|

Wages: |

$450.00 |

|

Hours: |

0 |

|

Class Code: |

1560 |

|

Pay Rate: |

0.00 |

Adjustment records and contributions

When making an adjustment, you will also need to calculate the correct member contribution amounts to be withheld from the employee's pay. If the wages are being paid in the same fiscal year (July 1-June 30) in which they were earned, use the same member contribution rate that you used for the last set of posted wages for that school fiscal year.

For example, you have an employee who has posted earnings of over $15,000 in a tiered benefit plan at the time you make the adjustment. Even if you are adjusting pay periods earlier in the year when the member contribution percentage was lower, you will use the current member contribution rate.

If the wages are being paid for a previous fiscal year, use the same member contribution rate that you used for the last set of posted wages for that fiscal year. If you are reporting current wages along with the adjustment, these may require separate calculations.

The employer contribution rate for any adjustment is the rate in effect for the adjustment record's pay period end date. So, employer contributions for adjusted wages paid in the fall for the previous school fiscal year (July 1 - June 30) are calculated using the previous fiscal year's contribution rate.

Make adjustments to prior pay periods on your most current unposted payroll report. Any employer and employee contribution payment required as a result of a positive adjustment record is due on the same date as payment for the report on which the adjustment appears.

Last updated: 08/05/2022