The web Browser you are currently using is unsupported, and some features of this site may not work as intended. Please update to a modern browser such as Chrome, Firefox or Edge to experience all features Michigan.gov has to offer.

7.03.08: Reporting retiree wages and hours on a DTL2 record

7.03.08: Reporting retiree wages and hours on a DTL2 record

Report retirees using a Detail 2 (DTL2) record and a Detail 4 (DTL4) record.

There is no difference between retiree DTL4 records and active member DTL4 records.

The laws regarding working after retirement are covered in section 9: Retirees Who Return to Work and the Reporting Retiree web page. ORS offers tools to help you report retirees employed by your reporting unit, review these tools for each retiree.

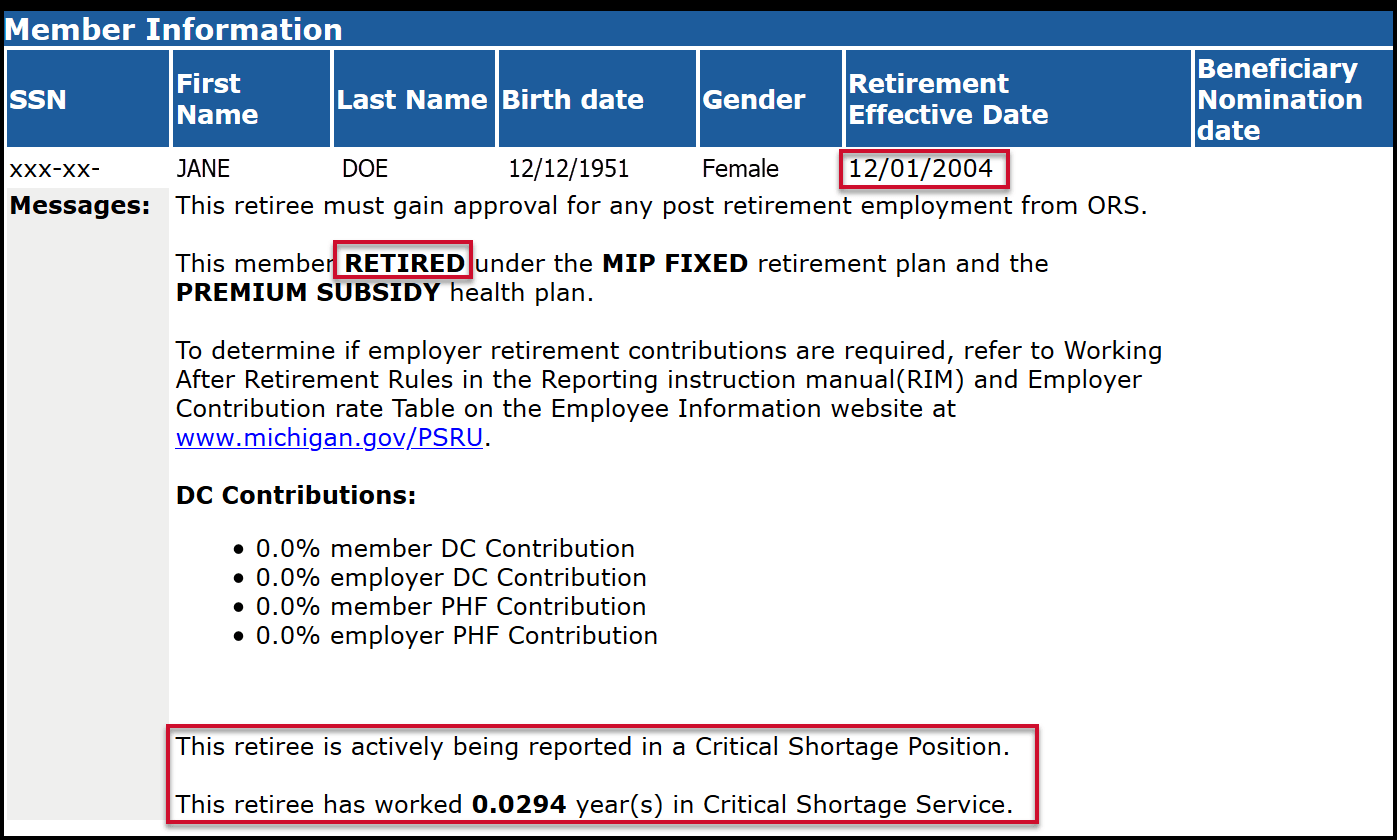

- The Member Benefit Plans section of the Employer Reporting website will verify that your new employee is a MPSERS retiree. In addition, the Member Benefit Plans link gives you the retirement effective date, information on employer and employee Defined Contribution rates when appropriate. This information will be specific to each employee. See section 7.06.01: Determining a member's benefit plan. You will need this information when using the Working after retirement - employer guide.

- The Reporting Retirees section of the Employer Information website provides you information and reporting for your retired employees. This includes the link to the Working after retirement - employer guide.

Reporting retirees' hourly wages

For retirees who return to work on an hourly basis, report the hours and gross wages according to your payroll calendar on the pay cycle when it was paid, not earned. See section 9.01: Earnings of retirees who return to work for the rules on reporting retiree earnings. Note that for retirees only, even payments that are considered nonreportable for active members should be included on the DTL2 and DTL4 records as reported wages. In addition, retiree wages must always be reported with hours.Reporting retirees with a contract

Always report according to your payroll calendar, even if your reporting unit arranges a contract with a retiree and chooses to pay that person a predetermined amount for the year. If your reporting unit chooses to pay a retiree over 26 pay periods, report the wages in the actual pay periods they are paid. Always include hours on a retiree's DTL2 record so it does not suspend.

Example

A reporting unit negotiates a contract with a retiree for $13,000 in total compensation for working two hours a day at $25/hour.

- $25/hourly rate.

- 2 hours a day ($50/day rate).

- 10 business days a pay period.

- 26 pay periods.

50 x 10 = 500 x 26 pay periods = $13,000

On your DTL2 record, report 20 hours and $500 gross wages for each pay period throughout the payroll calendar. Do not change the hours or wages for the retiree in a way that is inconsistent with your payroll calendar.

If a retiree works in more than one position, you may combine all wages and hours onto one DTL2 record under one employment class code as long as the class code is valid for the wages being reported. If the positions have different pay rates, calculate the average pay rate and report the wages on one DTL2 record.

Wage codes

For all retiree DTL2 records, use wage codes 07, 75 or 76.

- Use wage code 07 - Retiree Wages to report regular retiree wages and hours.

- Use wage code 75 - Retiree Wages Positive Adjustment for positive adjustments.

- Use wage code 76 - Retiree Wages Negative Adjustments for negative adjustments.

For more information on wage codes, see section 13.02.02: Detail 2 records - wage codes.

Employment class codes

To determine the appropriate employment class code see the Reporting Retirees section of the Employer Information website for information on reporting your retired employees. This includes the link to the Working after retirement - employer guide. For more information on class codes, see section 13.02.01: Detail 2 records - employment class codes and definitions for the full list.

Report retiree gross wages and hours on a DTL2 record.

DTL2 record fields for reporting retirees

- Reported Wage Code - Wage codes 07, 75 and 76 are the only wage codes that can be used to report wages with the 9025retiree class code. See section 13.02.01: Detail 2 records - employment class codes and definitions.

- Employer Reported Wages - Enter wages paid. See section 9.01: Earnings of retirees who return to work.

- Employee Contributions - Leave this field blank. Retirees do not make defined benefit employee contributions.

- Employer Contributions - Leave this field blank. Employer contributions are not made.

- Employment Class Code - Enter the 9005 or 9025 retiree class code.

- Contract Begin Date: (MM/DD/YYYY) - Enter only if Pay Rate is equal to or greater than $100.00.

- Contract End Date: (MM/DD/YYYY)- Enter only if Pay Rate is equal to or greater than $100.00.

Last updated: 08/04/2022