The web Browser you are currently using is unsupported, and some features of this site may not work as intended. Please update to a modern browser such as Chrome, Firefox or Edge to experience all features Michigan.gov has to offer.

7.01.08: Using the Download Detail link

7.01.08: Using the Download Detail link

The Download Detail link on your View Report Totals screen opens your submitted report in a spreadsheet format. Download detail files are available for both posted and unposted payroll reports. This tool helps to find discrepancies in defined benefit (DB) and defined contribution (DC) member and employer contribution amounts, which allows you to reconcile your records.

Note: The totals on a 100% posted report can never be changed.

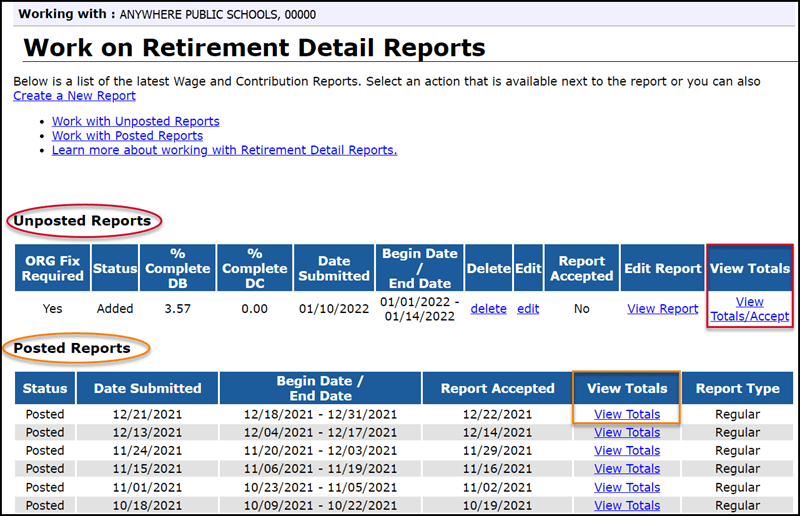

- Click Work on Reports on the Things To Do menu. For an unposted report click the View Totals/Accept link under the View Totals column. For a posted report click the View Totals link in the View Totals column.

- The link for the Report Totals for Regular and Adjustments download detail is near the bottom of the View Report Totals screen. There are also download detail links for three other sections — Posted W&C (Wage and Contribution) Information, W&C Not Yet Posted, and Total Adjustments (Posted and Not Posted) — which show only the data for that section. Click the Download Detail link for the section for which you require data.

Reading a Download Detail file

A Download Detail spreadsheet has columns for each of the fields on all four record types.

Columns A through E:

A — SSN

B — Name

C — Benefit Plan: Lists the member retirement benefit plan or displays Retiree if the employee has retired from MPSERS and has returned to work. (See Chapter 6: Member Benefit Plans and Contributions for specific plan information)

D — Healthcare Contribution %: Displays data for DTL2 records only. A 3 indicates the employee has the Premium Subsidy healthcare benefit and 3% of their reported wages will be applied to that fund. A 0 indicates that the employee has a different healthcare option, see column E.

E — Health Choice: Displays for DTL2 records only. The field is blank for those who have Premium Subsidy (see column D); the field shows PHF if the employee has the Personal Healthcare Fund. D – d

Columns F through M:

F — Record Begin Date: The pay period begin date on the DTL2 record (mmddyyyy).

G — Record End Date: The pay period end date on the DTL2 record (mmddyyyy).

H — Section Code: Indicates the record type: DTL1 — Demographics, DTL2 — Wage and Service, DTL3 — TDP Deductions, DTL4 — DC Contributions.

I — Wage Code: Wage code on the DTL2 record. (See section 13.02.02: Detail 2 records - wage codes for specific codes.)

J — Class Code: Class code used to report wages on the DTL2. (See section 13.02.01: Detail 2 records - employment class codes and definitions for specific codes.)

K — Employer Reported Wages: Dollar amount of wages reported on the DTL2 record for employees reported with an active class code.

L — Employer Reported Wages (Retirees): Dollar amount of wages reported on the DTL2 record for employees reported with a retiree class code.

M — Exception Wages: Wages as they appear in the Exception Wages field on the DTL2. Exception wages are reported only for Professional Services Leave or Released Time and with class code 9001. (See section 7.03.06: Reporting professional services leave/professional services released time on a DTL2 record for more information.)

Columns N through Q:

N — Member Contributions Reported: DB contribution dollar amount reported on the DTL2 record.

O — Member Contributions Calculated: DB contribution dollar amount calculated by ORS.

P — Member Contribution Discrepancy: Dollar amount difference between contributions reported and contributions calculated by ORS.

Q — Member UAAL Contribution: For future use, per Public Act (PA) 92 of 2017, as the need arises.

Columns R-V:

R — Employer Contributions Reported: DB contribution dollar amount reported on the DTL2 record.

S — Employer Contributions Calculated: DB contribution dollar amount calculated by ORS.

T — Employer Contributions Discrepancy: The difference between the reported and calculated employer DB contribution.

U — Hours: Number of service hours reported on the DTL2 record.

V — Pay Rate: Pay rate reported on the DTL2 record.

Columns W-Z:

W — Agreement #: Tax-Deferred Payment (TDP) Agreement number.

X — Invoice #: Tax-Deferred Payment (TDP) Agreement invoice number.

Y — TDP Period End Date: Effective pay period end date of TDP payment on the DTL3 record.

Z — TDP Deduction Amount: Dollar amount of employee TDP payment on the DTL3 record.

Columns AA-AG:

AA — DC Record Type: DTL4 record type: 1-Regular, 5-Positive Adjustment, 6-Negative Adjustment.

AB — Gross Wages: Amount of wages reported on the DTL4 record.

AC — Reported Member DC Contributions: Dollar amount of member DC contributions reported on the DTL4 record.

AD — Calculated Member DC Contributions: Dollar amount of member DC contributions calculated by ORS.

AE — Member DC Contribution Discrepancy: The difference between the member DC contributions reported and calculated.

AF — Reported Member DC %: Percentage of member DC contributions reported on the DTL4 record.

AG — Calculated Member DC %: Percentage of member DC contributions calculated by ORS.

Columns AH-AL:

AH — Reported Employer DC Contributions: Dollar amount of employer DC mandatory/DC match contributions reported on the DTL4 record.

AI — Calculated Employer DC Contributions: Dollar amount of employer DC contributions calculated by ORS.

AJ — Employer DC Contribution Discrepancy: The difference between the employer DC contributions reported and calculated.

AK — Reported Employer DC Match %: Percentage of employer DC contributions reported on the DTL4 record.

AL — Calculated Employer DC Match %: Percentage of employer DC contributions calculated by ORS.

Columns AM-AN:

AM — Status Change Date: For use only if employee is terminating service with the employer. (Must also populate Status Change Reason Code field. DTL4 will suspend if only one of the two fields are populated.)

AN — Status Change Reason Code: For use only if employee is terminating service with employer. (Must also populate Status Change Date field. DTL4 will suspend if only one of the two fields are populated.)

Columns AO-AS:

AO — Reported Member PHF Contributions: Dollar amount of member PHF contributions reported on the DTL4 record.

AP — Calculated Member PHF Contributions: Dollar amount of member PHF contributions calculated by ORS.

AQ — Member PHF Contribution Discrepancy: The difference between the member PHF contributions reported and calculated.

AR — Reported Member PHF %: Percentage of member PHF contributions reported on the DTL4 record.

AS — Calculated Member PHF %: Percentage of member PHF contributions calculated by ORS.

Columns AT-AX:

AT — Reported Employer PHF Contributions: Dollar amount of employer PHF contributions reported on the DTL4 record.

AU — Calculated Employer PHF Contributions: Dollar amount of employer PHF contributions calculated by ORS.

AV — Employer PHF Contribution Discrepancy: The difference between the employer PHF contributions reported and calculated.

AW — Reported Employer PHF %: Percentage of employer PHF contributions reported on the DTL4 record.

AX — Calculated Employer PHF %: Percentage of member PHF contributions calculated by ORS.

Columns AY-AZ:

AY — Transfer Status: If the DTL4 record has been transferred to Voya Financial, the column will display Transferred. If the DTL4 record has not been transferred to Voya the column will display Not Transferred.

AZ — IRS Limit Reach: If the employee has reached the calendar year contribution limit with Voya the column will display Yes. If the employee has not reached the calendar year contribution limit it will display No. The ORS system stops calculating all member and matching employer contributions when the IRS limit is reached; and continues to calculate only mandatory employer contributions. NOTE: The calculations reflect contributions reported to ORS from reporting units only. Employees who have other retirement accounts are responsible for ensuring their total contributions do not exceed the annual IRS limits.

Last updated: 09/21/2023